AutoHouse Technologies has released its Q1 2023 benchmark findings to help industry better understand how auto repair facilities in B.C. perform in comparison with their western neighbours.

In the dynamic and highly competitive collision repair industry, data collection plays a crucial role in driving success and achieving operational excellence. The systematic collection and analysis of data provide valuable insights into various aspects of the repair process, enabling businesses to make informed decisions, improve efficiency, enhance customer satisfaction, and drive financial performance. From tracking key performance indicators (KPIs) to analyzing repair trends and identifying areas for improvement, data empowers collision repair businesses to stay ahead of the curve and deliver exceptional outcomes for their customers.

To collect concrete evidence about the current state of the industry, the western alliance of collision repair associations—Automotive Retailers Association (ARA), Saskatchewan Association of Auto Repairers (SAAR), and Automotive Trades Association of Manitoba Inc. (ATA)—contracted AutoHouse Technologies to deliver quarterly benchmark reports.

The benchmark evaluates the performance of Canadian collision repair facilities using key indicators such as average repair severity, labour hours, and average cycle time and touch time. These indicators are important tools for determining repair efficiency and identifying areas for maximizing productivity and increasing net profit.

Sales

Monthly sales revenue varies greatly based on location, facility size, and mix of business. Even though monthly sales revenue would not typically be considered an indicator of performance, it provides some interesting comparison of the four western provinces. Average monthly sales in B.C. have reached the highest rate since before the Covid-19 pandemic began impacting the industry. The delay on non-drivable claims in B.C. continues to be a factor as shops prioritize the most profitable work, which is likely to increase the total cost due to the complexity of repair and parts.

- British Columbia – $348,769

- Alberta – $293,109

- Saskatchewan – $338,940

- Manitoba – $344,791

The benchmark also provides a breakdown of average repair order (RO) labour sales, including labour operations such as body, frame, and mechanical. Repair orders have increased from an average just below $4,000 (Q4 2019) to $5,147 (Q1 2023), resulting in British Columbia having the highest total labour rate ($1,414) and body labour rate ($1,261).

Regarding compensation allocated to consumables used in the repair process, Saskatchewan collision repair centres are the most compensated for paint materials ($537), while the highest compensation for body materials was recorded in Alberta ($131).

An analysis of the parts purchased in each province shows that Alberta spends a significantly higher amount on parts compare to the other regions. Some potential factors that could influence these findings are repair vs. replace, mix of work, and private vs. public insurance. Industry in British Columbia continues to perform well when looking at alternate parts usage as the OEM parts usage is the lowest of the western provinces. As the alternate part sales are not disproportionate to the other provinces, it shows that British Columbia is doing a good job of repairing versus replacing, substantiated by the higher labour hours.

- British Columbia – $2,097

- Alberta – $3,206

- Saskatchewan – $2,276

- Manitoba – $2,332

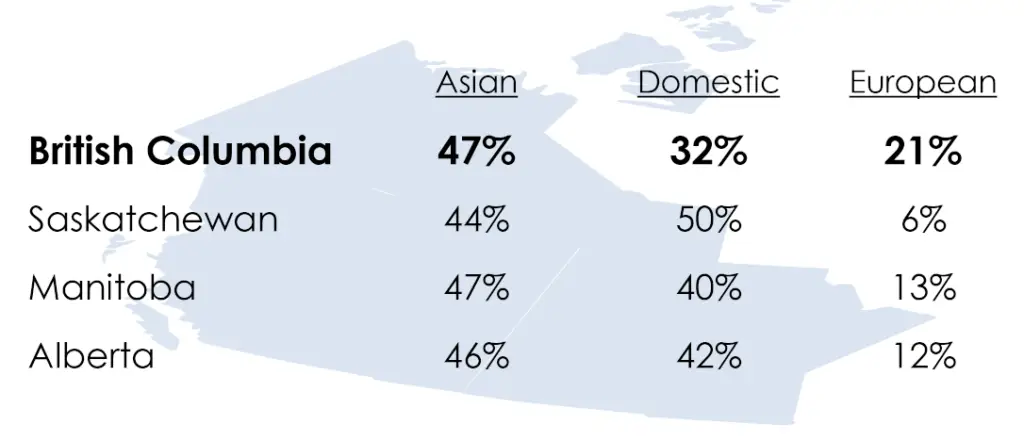

Average hours per RO, including total labour hours and refinish labour hours, are higher in B.C. and Alberta. This can be attributed to a larger European repair mix and larger light truck influence, respectively.

- British Columbia – 25.8

- Alberta – 26.1

- Saskatchewan – 22.1

- Manitoba – 22.4

Repair Mix

The repair mix by manufacturer origin provides some interesting insights. The highest average percentage of domestic repairs correlates with the highest average repair sale. One could assume this is influenced by a higher percentage of light truck repairs.

Repair size influences average repair sale and, in most cases, other operational performance indicators such as touch time and cycle time. On average, over 60% of repairs are 20 hours or less. Shops that have processes in place to efficiently handle small repairs are typically the strongest performers in touch time and cycle time.

Cycle time

While cycle time remains a commonly used key performance indicator, it is not effective for measuring true comparative performance between repairers because it does not consider work mix (OE brand and repair size) and geographic location. Only when these factors are considered can cycle time be used to provide effective insight into relative performance.

While the cycle time in British Columbia, Manitoba, and Saskatchewan ranges between 12.0 and 13.1 days, in Alberta it is 15.9 days. The report does indicate that in British Columbia shops are doing a great job at managing WIP. Although B.C. shops are seeing an average 1.5 day arrival to start, the highest over the past years, they’re still performing better than their western counterparts. The Start to Complete is higher than others which leads one to surmise that is due to more repairs. This is supported by B.C.’s higher levels of repairs in all category of hourly breakdown (medium >20hrs and heavy >40hrs).

Touch time

In its benchmark, AutoHouse Technologies suggests that touch time is the most appropriate measure when comparing overall performance, measuring how efficiently repairers process available work regardless of repair size.

Steady production is what makes a collision centre successful. In British Columbia, auto body shops work on average 2.5 hours/day on a repair order, which is the highest touch time among all four analyzed provinces. Saskatchewan has an average touch time of 2.4 hours per day, Manitoba has 2.3 hours per day, and Alberta has 2.1 hours per day.

Shops in British Columbia should use these results for any insurer that might question your parts decisions. This report demonstrates shops in British Columbia have better than average control in this area with the lowest average parts sales, while maintaining high repair percentages.

The full benchmark results can be found here.

The ARA encourages all collision repair members to take part in the benchmark to contribute to the industry’s advancement. To learn more about benchmark participation, visit autohousetechnologies.com/assocbenchmark and be a part of shaping the future.