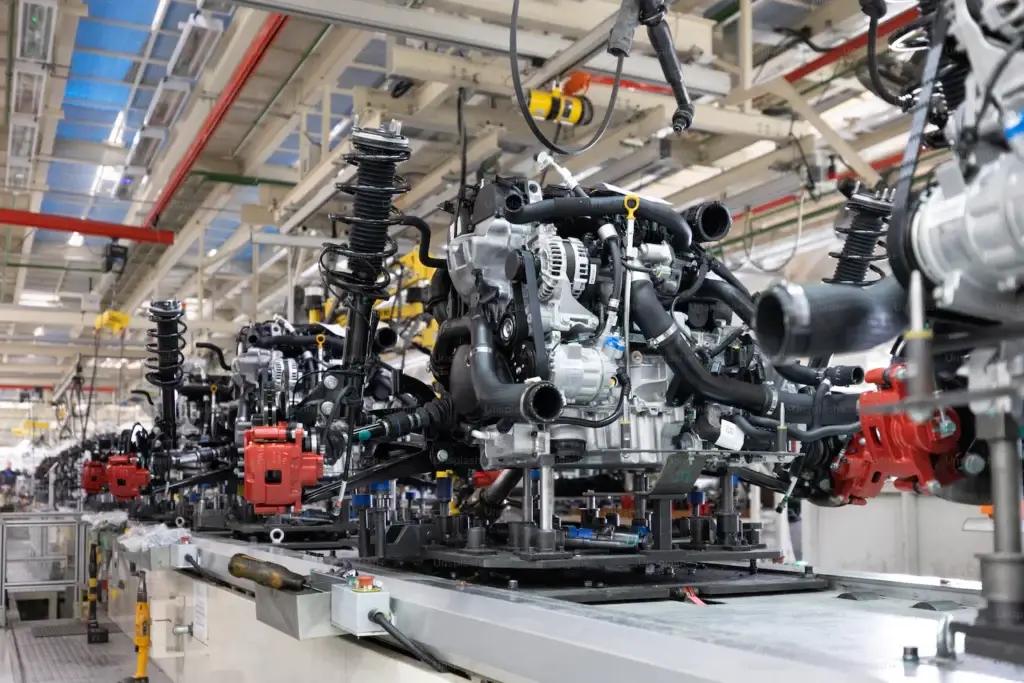

For years, the relationship between Canada and Mexico’s auto industry remained strong. In total, “there are over 60 Canadian car part companies operating in Mexico, with over 130 plants in 14 states, employing approximately 30,000 Mexicans”. This partly stems from the North American Free Trade Agreement (NAFTA), which was put into effect back in 1994. This agreement would encourage business between North American nations for years to come until it was reworked into the United States-Mexico-Canada Agreement (USMCA) in 2020, continuing to promote similar objectives. Ultimately, these agreements aim to enhance economic growth in these countries and support domestic trade, including in the automotive sector.

Despite years of close collaboration among these three North American countries, China’s increasing presence in Mexico’s automotive market is becoming noticeable. Recently, the Mexican Association of Automotive Distributors (AMDA) reported that “the share of the car market that belongs to Chinese brands rose by almost 6% this past September, to reach 19.4% of overall sales in the first nine months of 2023” in Mexico, as reported by El País. It was also reported that Mexico, a country that manufactures vehicles for export to the United States and Canada, has become the second-largest importer of Chinese cars, following Russia. This shows the growing influence of Chinese cars in Mexico, potentially impacting Canadian and U.S. automotive industries.

Flavio Volpe, president of the Auto Parts Manufacturers Association, explained that his organization is concerned about the implications of these changing circumstances. He stated that China is benefitting from its friendly relationship with Mexico by bypassing regulatory hurdles that would be more difficult to work around when trading with the U.S. or Canada. Volpe fears that this state-sponsored competition from China could lead to significant losses in both profits and jobs for Canadian auto parts manufacturers.

More than 65 Canadian automotive companies, operating about 120 factories in Mexico and employing over 44,000 people, now face competition from Chinese firms. This rivalry could intensify as Mexico supports the increasing presence of Chinese vehicles.

Canada’s car part companies operating in Mexico would have to compete with Chinese companies that will inevitably establish themselves in Mexico, as the country will have to sustain its growing number of Chinese cars more effectively.

China’s influence is also evident in the electric vehicle (EV) market. As electric vehicles are becoming more common and widely promoted due to their environmental and long-term cost benefits, China has made its presence known in the industry. As the world’s largest EV market in the world, China’s recent restriction on graphite export, a crucial component in EV batteries, caused disruptions for North American manufacturers. This caused some slowdowns in their production.

To address China’s escalating influence in the automotive market, Volpe suggested that elected officials and governments in Canada and the U.S. should take action and respond to China’s quickly developing strategies.

In contrast to the U.S., Canada lacks a consumer incentive program regulating the origin of vehicle batteries. Brian Kingston, president of the Canadian Vehicle Manufacturers’ Association, said “Canada benefits when we keep our automotive industry aligned with the U.S., our biggest customer and most important automotive trade partner.” He suggests that Canada’s best course of action may be to restrict the use of non-North American car parts in the Canadian automotive market, including its operations in Mexico.